what is fsa/hra eligible health care expenses

CARES Act Expands Eligible Expenses to Include OTC and Feminine Hygiene Products - 3272020 The Coronavirus Aid Relief and Economic Security CARES Act was signed into law on Friday March 27th. Download here Introducing the Adoption Assistance Program Part of a family-friendly and inclusive.

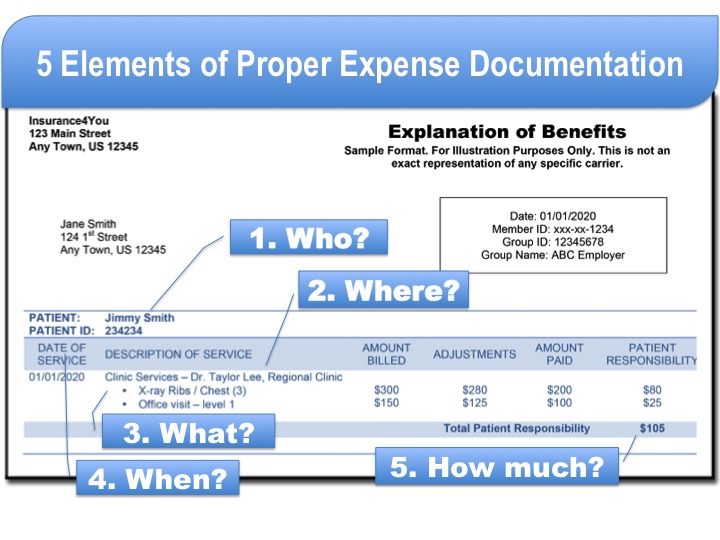

Five Basic Questions To Ensure Your Receipt Is Accepted Bri Benefit Resource

Annual Dependent Care Claim Form opens PDF file.

. Dependent Care FSA max election per year. Here it is the most-comprehensive eligibility list available on the web. Dependent Care Spending Account Worksheet opens PDF file.

FSA Claim Form opens PDF file. Check your plan details for more information. Medical Savings Accounts Archer MSAs and Medi-care Advantage MSAs.

Adoption fees associated with and medical expenses for adopted child The expenses associated with the adoption of a child are not eligible for reimbursement with a flexible spending account FSA health savings account HSA health reimbursement arrangement HRA limited-purpose flexible spending account LPFSA or dependent care flexible spending account. More about Further COVID regulatory updates Weve organized the regulation changes regarding COVID-19 in a white paper and infographic. Health and Limited-Purpose FSAs are for eligible expenses incurred by the employee their spouse or eligible dependents.

FSA is flexible spending account or arrangement. Direct Deposit Authorization opens PDF file. Eligible Eligible for reimbursement.

Together we look forward to serving our combined employer clients through our HSA FSA HRA COBRA Direct bill commuter fitness and education reimbursement programs. Vantages to offset health care costs. Preschoolnursery school for pre-kindergarten.

Payroll taxes related to eligible care. Your HSA funds can then be used tax-free to pay for qualified medical expenses. 1 Accounts must be activated via the HealthEquity website in order to use the mobile appReturn to content.

An HSA may receive contributions from an eligible indi-. 2 The example used is for illustrative purposes only. One component of the law was an expansion of products eligible for reimbursement from health savings accounts HSAs and medical flexible spending.

Health Reimbursement Arrangements HRAs. From A to Z items and services deemed eligible for tax-free spending with your Flexible Spending Account FSA Health Savings Account HSA Health Reimbursement Arrangement HRA and more will be here complete with details and requirements. Just open the MyHealth mobile app select Eligible Expense Scanner from the menu then simply scan the item barcode to find out if it can be paid for using your health account.

HRA is health reimbursement account or arrangement. For a complete list of IRS-qualified medical expenses visit irsgov or view a list of qualifying examples. Health Flexible Spending Arrangements FSAs.

We are a team of dedicated professionals. In addition your HSA contributions earn tax-free interest and carry over from year-to-year even if you change jobs or retire. Eligible expenses in an HRA will vary depending on plan design.

By selecting an HSA-qualified plan you are eligible to contribute tax-free money into a health savings account HSA. Spend every day wiselySM Health savings and spending accounts to fit your life. HSAs HRAs and FSAs are accounts used to save on taxes and pay for qualified medical prescription dental and vision expenses.

Letter of Medical Necessity opens PDF file. Eligible expense scanner on the MyHealth mobile app Our new barcode scanner takes the guesswork out of what items the IRS considers qualified expenses. This includes deductibles co-insurance prescriptions dental and vision care and more.

With more than 1400 people working for us TASC is able to serve businesses of all sizes across every state in the US. Doc Additional documentation required. Health Savings Accounts HSAs.

This publication ex-plains the following programs. SAMPLE CHART OF ELIGIBLE EXPENSES Please note that this is not a complete list but is intended to provide Plan participants with examples to help determine what OTC items may be an eligible expense. Unlimited Health Savings Accounts HSAs HDHP min annual deductible - Self-only.

Actual savings may vary. You can pay for a wide range of IRS-qualified medical expenses with your HSA including many that arent typically covered by health insurance plans. Transportation to and from eligible care provided by your care provider.

Registration fees required for eligible care after actual services are received Sick-child care center. Eligible Expenses Benefit Limits Consumer Protection Program Plan Advisor. HSA Health FSA and HRA Eligible Expenses ConnectYourCare 2021-12-22T101136-0500 There are thousands of eligible expenses for tax-free purchase with a Health Savings Account HSA Flexible Spending Account FSA and Health Reimbursement Arrangement HRAincluding prescriptions doctors office copays health insurance.

The figure is based on average tax rates including state federal and FICA taxesReturn to content. Over-the-Counter Contraception Obtained Without a Prescription. The Qualified Small Employer HRA is available to employers with less than 50 employees who do not offer a traditional group health plan to subsidize health care coverage or out of pocket medical expenses.

Limited Medical FSAHRA Plan participants should check their Plan Highlights to see if OTC items are eligible. As the nations largest privately held third party benefits administrator TASC has a mission to improve the health wealth and well being of its customers employees and communities. HealthEquity and WageWorks have joined together to help working families connect health and wealth.

Dependent Care FSA Carryover NA. Transit Account A Transit Account enables you to set aside funds on a pre-tax basis to pay for eligible workplace mass transit expenses such as the price of tickets vouchers and passes to ride a subway train or city bus or the costs of transportation in a commuter highway vehicle eg vanpool if such transportation is for purposes. Health and Limited-Purpose FSAs.

Healthcare FSA Carryover 570. FSA Eligible Expenses opens PDF file. A dependent care FSA can be used for expenses incurred to care for children age 12 and younger as well as adult tax dependents who are unable to care for themselves while you are at work.

Flex Frequently Asked Questions FAQ opens PDF file. If you are enrolled in a Limited Medical FSA or Combination Medical FSA your eligible expenses may be different. HSA is health savings account.

HealthEquity does not provide legal tax or financial advice. If the plan or insurer does not cover the entire cost of an over-the-counter OTC contraceptive participants may seek reimbursement from their standard health FSA health savings account HSA or a health reimbursement arrangement HRA that considers OTC expenses as eligible. We are here to help during COVID-19.

WEX Advantage User-tested and approved employer portal provides self-service capabilities to keep the small group administration light.

Fsa Hra Eligible Expenses Mychoice Accounts Businessolver

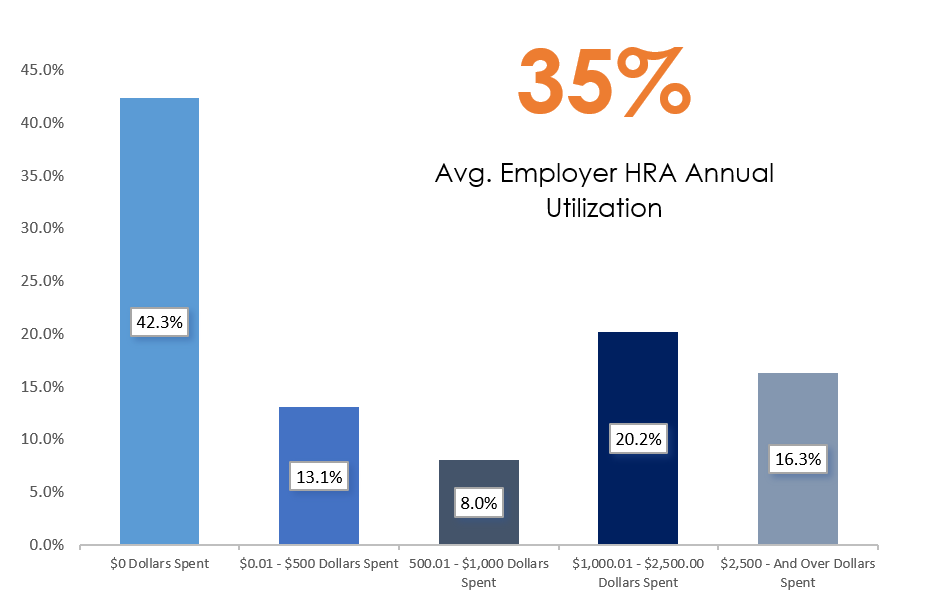

Health Reimbursement Arrangement Hra Oca Flexible And Compliant Pre Tax Benefits And Cobra Administration Backed By Industry Leading Support

That S Eligible Fitness Expenses And Your Flexible Spending Account

Why Is Documentation Required For Every Fsa Purchase

Compare Hsas Hras And Fsas Myhealthmath

How To Use Your Fsa Or Hsa For Allergy Products Goodrx

The Bluesaversm Hsa From Bank Of America Ppt Download

Demystifying Employee Benefits And Cdh Accounts

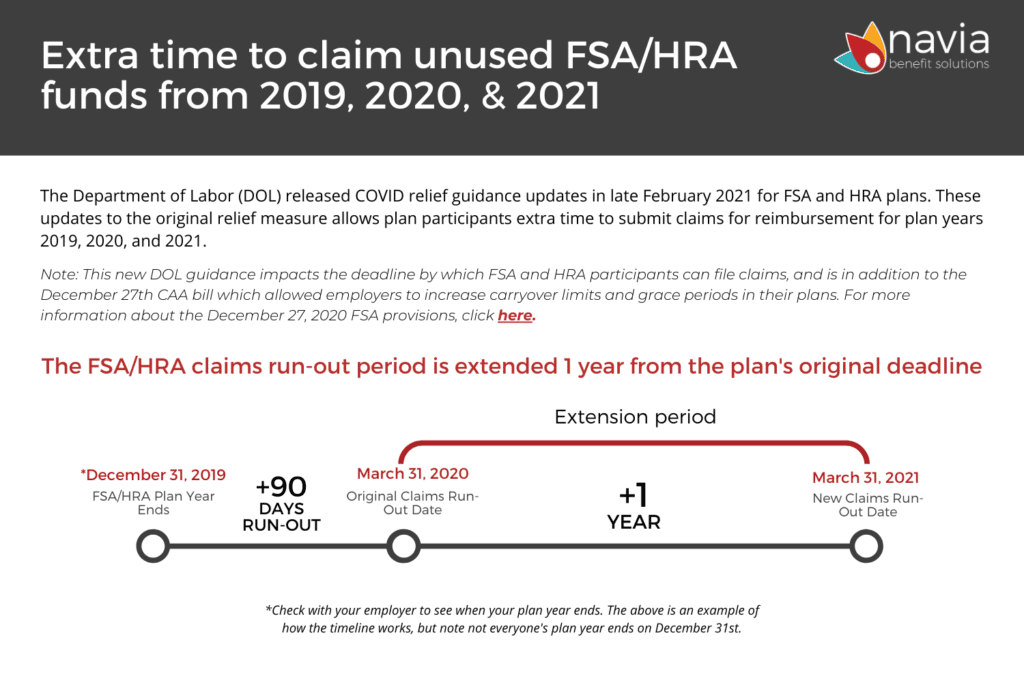

Cobra Subsidies Fsa Dependent Care Increase And Benefit Extensions From Arpa Navia